Broking Services

Barclays Securities India Pvt Ltd, offers robust platform to its clients to trade in Equities cash segment, ETFs, Equity Derivatives, Currency Derivatives through NSE & BSE and other investment options like Offer for Sale, IPOs etc. Investors are provided with an execution platform along with unbiased research across sectors, economy and scripts.

|

Name |

Registration Number |

Registered Address |

Branch Address |

Contact Number |

Email id |

|---|---|---|---|---|---|

|

Barclays Securities (India) Pvt Ltd |

INZ000269539 |

Nirlon Knowledge Park, 9th floor, Block B-6, Off. Western Express Highway, Goregaon (East), Mumbai – 400063, India |

Level 9, |

Mr. Yezad Mistry 022-61754068 |

|

Sr. No. |

Name of the Individual |

Designation |

Contact Number |

Email ID |

|---|---|---|---|---|

|

1. |

Mr. Deepak Agarwal |

Whole-time Director |

022-61754011 |

|

|

2. |

Mr. Narayan Shroff |

Whole-time Director |

022-61754053 |

|

|

3. |

Ms. Amisha Depda |

Company Secretary |

+91 98921 36321 |

|

|

4. |

Mr. Vaibhav Purohit |

Chief Compliance Officer |

022-61752271 |

Procedure for opening a Broking Account

Any resident of India or Non Resident Indian with the necessary documentation can open a broking account in India.

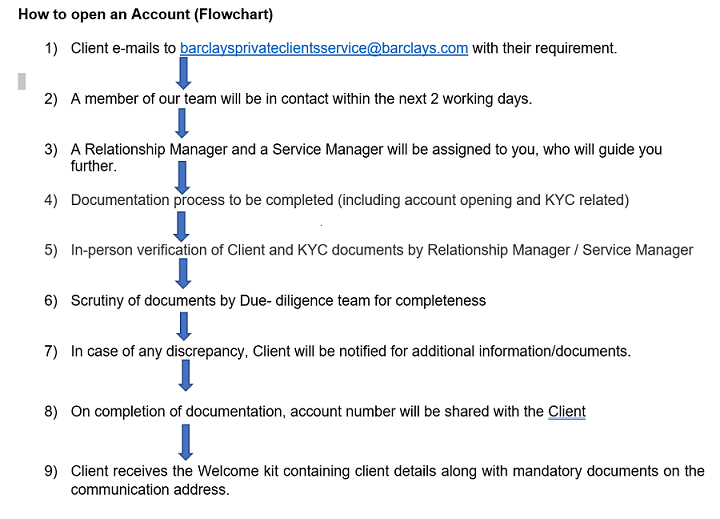

How to open Broking account?

- Client to send e-mail to barclaysprivateclientsservice@barclays.com with their requirement.

- A member of our team will be in contact within the next 2 working days.

- A Relationship Manager and Service manager will be assigned to you who will help you with the documentation and process to be followed.

- Fill account opening form and other document process.

You will need to fill out an application form for opening a new Broking account. Along with this, you will need to submit any of OVD(s) , PAN card, Bank details, demat details, and your personal details.

PAN: This is compulsory for opening a Broking account. Please ensure PAN-Aadhaar linkage has been done.

We also have a e-signing option through Leegality.

5. Verification process

The Relationship Manager / Service Manager will conduct an in-person verification of you and your KYC documents.

6. Final approval

Once your documents are verified, and the final formalities are completed, your new Broking account will be opened. You will also be given the Unique Identification Number for your account.

There is a provision to nominate upto 3 nominees who will be the beneficiary/ies in the event of death of the Account holder. (the percentages allocated to the nominees should add to 100). The nominee/s can be changed or updated in the future as per the wishes of the account holder. In case of the holder choosing to not nominate, an Opt-out of nomination form is to be submitted.

List of OVD(s)

In order to open a Broking account, you will require to submit any one OVD (Officially Valid Documents).

Officially Valid Documents (OVD) applicable from 1st Jan 2023 onward:

- Proof of possession of Aadhaar

- Driving License

- Passport

- Voter ID

- NREGA Job Card

- National Population Register (NPR) letter

Copies of all documents that are submitted need to be compulsorily self-attested by the applicant and accompanied by originals for verification.

For NRIs - In case OSV is not possible, notarization of documents from respective country will be required (as per local laws)

For Non-individuals :

1) Certified true copy of KYC documents to be submitted

2) Shareholding drilldown upto 10% threshold (direct and indirect) will be required

For all clients (Individuals or non Individuals) : Our Relationship Manager may require to understand your financial journey and background - to comply with KYC and PMLA guidelines

In case officially valid document (OVD) does not contain updated address, the following documents shall be deemed to be officially valid documents for the limited purpose of proof of address:

- Utility bill which is not more than two months old of any service provider (electricity, telephone, post-paid mobile phone, piped gas, water bill)

- Property or Municipal tax receipt

- Pension or family pension payment orders (PPOs) issued to retired employees by Government Departments or Public Sector Undertakings, if they contain the address

- Letter of allotment of accommodation from employer issued by State Government or Central

- Government Departments, statutory or regulatory bodies, public sector undertakings,

scheduled commercial banks, financial institutions and listed companies and leave and license agreements with such employers allotting official accommodation: Provided that you shall submit updated officially valid document with current address within a period of three months of submitting the above documents.

The following 6 KYC attributes - Name, Pan , Address, Income range, mobile number and email id are mandatory to be provided.

For clients who are not yet registered on KRA/CKYC or where change in KYC is required to be updated with KRA/ CKYC, we shall register with KRA/CKYC or update the details therein.

Post submission of Account opening form along with supporting document, BSIPL will review the documents submitted.

In case of any discrepancy, relationship manager/service manager will contact the Client for additional information/documents.

Once complete documentation is completed the BSIPL will generate an account number.

Service manager/relationship manager will share the account details with the Client.

BSIPL will dispatch the Welcome kit containing client details along with mandatory documents and booklets to the client communication address.

Procedure for filing a Complaint

Procedure for finding out status of the complaint.

Once a complaint is received, it is logged into our records, with a unique complaint ticket number. This complaint ticket number is shared with the Complainant.

The Complainant can get in touch with the Service Manager, quote his complaint number and get the status of his complaint.

|

Sr. No. |

Authorised Person's name |

Authorised Person code (Exchange wise ) |

Constitution |

Status |

Registered Address |

Terminal details (Exchange wise) |

|---|---|---|---|---|---|---|

|

1. |

Barclays Investments & Loans (India) Private Ltd |

NSE |

Company |

Approved |

Nirlon Knowledge Park, Level 9, Block B-6, Off Western Express Highway, Goregaon (East), City - Mumbai |

Terminal Allotted - Nil |

|

2. |

Barclays Investments & Loans (India) Private Ltd |

BSE |

Company |

Approved |

Nirlon Knowledge Park, Level 9, Block B-6, Off Western Express Highway, Goregaon (East), City - Mumbai |

Terminal Allotted - Nil |

|

Sr. No. |

Authorised Person's Name |

Status |

Authorised Person Cancellation Details |

|---|---|---|---|

|

1 |

NIL |

NA |

Date - NA Reason - NA |

Details regarding margin requirements, collateral requirements and settlement calendar are mentioned/attached below:

Margin Requirements

- Cash Segment

- a. BSIPL charges margins equivalent to 1.25 times the margins charged by the Exchange i.e. (VaR, Extreme Loss Margin and Special/Adhoc Margins (if any)). See exchange margins for NSE and BSE.

- b. BSIPL charges additional adhoc margin from time to time for specific securities which shall be duly updated as and when levied.

- c. Any purchase of securities in cash equities under product type Cash and Carry (‘CNC’) shall attract 100% margins (upfront payment of settlement value), whereas any purchase under product type Normal (‘NRML’) or ‘Intra Day’ shall attract BSIPL margins as mentioned in ‘a’ and ‘b’ above.

- d. In case of Sale of securities in cash equities under product type ‘CNC’ (i.e. where securities are held in the Demat account of the client with BSIPL and where BSIPL has been granted Power of Attorney (POA)), no margin is charged by BSIPL. Further, only 80% credit exposure shall be granted against such sale value of shares under ‘CNC’. This will be granted once Early Pay-in of the Securities has been accepted by the Clearing Corporation and credit entry is posted in the ledger account of the client. For sale of shares under product type ‘NRML’ or ‘Intraday’, BSIPL margins as mentioned in ‘a’ and ‘b’ shall be applicable.

- Equity Derivatives Segment

- a. BSIPL charges margins equivalent to 1.25 times the margins charged by the Exchanges i.e. (Initial Margins (SPAN) and Exposure Margins). See Exchange SPAN and Exposure margins ,

- b. Mark to Market (MTM) margins are charged and collected basis by the exchange on a daily basis. The MTM margins shall have to be provided to BSIPL latest by 10.00 AM on T + 1 day. MTM margins shall always be collected and remitted to BSIPL’s Upstream bank account.

- c. Exposure in derivatives segment shall be provided only if the cash margins and the value of securities deposited as collaterals with BSIPL are sufficient to cover the margins requirements as mentioned in pt. ‘a’ above.

- Currency Derivatives Segment

- a. BSIPL charges margins equivalent to 1.25 times the margins charged by the Exchanges i.e. (Initial Margins (SPAN) and Exposure Margins). See Currency Derivative SPAN and Exposure margins.

- b. Mark to Market (MTM) margins are charged and collected basis by the exchange on a daily basis. The MTM margins shall have to be provided to the BSIPL latest by 08.00 AM on T + 1 day. MTM margins shall always be collected and remitted to BSIPL’s Upstream bank account.

- c. Exposure in derivatives segment shall be provided only if the cash margins and the value of securities deposited as collaterals with BSIPL are sufficient to cover the margins requirements as mentioned in pt. ‘a’ above.

Collateral Requirements

Clients may fund the margins requirements (depending on the product type) in various forms:

a. Cash – Clients may make available cash balances in BSIPL’s Broker margin bank account to fund their transactions.

b. Securities – Clients may pledge approved securities (NSE EQ [ZIP] / NSE FNO [ZIP]/ NSE CD [ZIP]) with BSIPL to obtain collateral margins against them. However, the value of the securities shall be arrived post deduction of haircut. The haircut shall be 1.25 times (VaR, Extreme Loss Margin and Special/Adhoc Margins (if any)).

Settlement Calendars

Broking Form (Individual & Non-Individual)

- Broking KYC Application Form Part 1 – Individuals

- Broking KYC Application Form Part 1 – Non-Individuals

- Broking Account Kit Part 2

- Broking Account Kit Part 3

- Nomination form for Broking

- Declaration form for Opt-out of Nomination

- Broking inactive account policy

Client Registration Documents (Rights & Obligations, Risk Disclosure Document, Do's & Don't's) in Vernacular Language (you may download below here):

| Assamese | Bengali | Gujarati | Hindi | Kannada |

| Kashmiri | Konkani | Malayalam | Marathi | Oriya |

| Punjabi | Sindhi | Tamil | Telugu | Urdu |

Note: This document is a translated version of the client registration documents in English and is being provided in vernacular language to facilitate better understanding by the investors. In case of any ambiguity, the contents of the English version would prevail.

Access documents on the NSE Website

Access documents on the BSE Website

Policy for handling Good Till Date Orders

Attention Investors

Prevent unauthorised transactions in your account --> Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. .......... Issued in the interest of Investors

Investors are cautioned not to blindly follow tips/rumours circulated via various mediums including social networks, SMS, WhatsApp, Blogs etc. while dealing in securities.

Investors should deal in securities only after conducting appropriate analysis. In case of any systemic wrong doing, potential frauds or unethical behavior noticed by Investors, please report about the same to NSE on http://www.nseindia.com/int_invest/dynacontent/any_portal.htm